TRX Price Prediction: Navigating Technical Support and Market Volatility

#TRX

- TRX is testing crucial technical support at $0.34 with mixed indicator signals

- Positive fundamental developments in USDT integration contrast with regulatory controversies

- Market sentiment remains cautious but optimistic amid institutional investment activity

TRX Price Prediction

TRX Technical Analysis: Key Support Test at $0.34

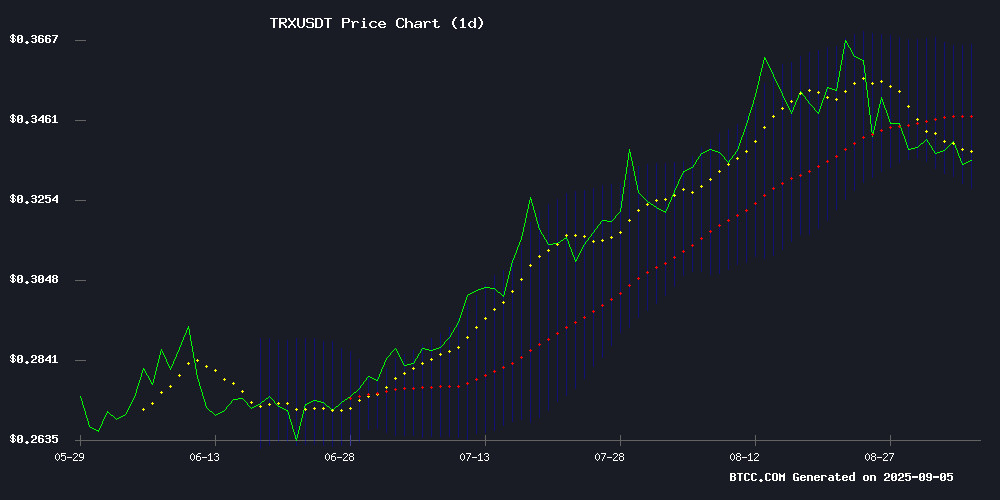

TRX is currently trading at $0.3312, testing crucial support levels amid mixed technical signals. According to BTCC financial analyst James, 'The price sitting below the 20-day moving average of $0.3467 suggests near-term bearish pressure, but the MACD showing positive momentum at 0.006903 indicates potential for reversal. The Bollinger Bands range of $0.3276 to $0.3658 defines the immediate trading channel.'

James notes that 'A sustained break above the 20-day MA could trigger momentum toward the upper Bollinger Band, while failure to hold $0.3276 support may lead to further downside testing.'

Market Sentiment Weighed by Regulatory and Political Developments

Recent news events are creating mixed sentiment for TRX investors. BTCC financial analyst James observes that 'While TRON's integration of USDT via deBridge enhances cross-chain functionality—a fundamentally positive development—the controversies surrounding Justin Sun's $20M commitment to Trump-backed projects and subsequent wallet freezes are creating uncertainty.'

James adds, 'The blacklisting incident and WLFI token collapse are concerning short-term factors, but the $110M treasury investment shows ongoing institutional confidence. Market sentiment appears cautiously optimistic despite headline volatility.'

Factors Influencing TRX's Price

TRON Integrates USDT via deBridge to Enhance Cross-Chain Stablecoin Liquidity

Tether's USDT, the dominant stablecoin with a market cap exceeding $82 billion on TRON alone, has deepened its cross-chain capabilities through integration with the TRON blockchain. deBridge's technology enables direct transfers without wrapped assets, addressing DeFi's liquidity fragmentation pain point.

TRON's network metrics validate its position as a stablecoin powerhouse: 327 million accounts, 11 billion transactions processed, and $28 billion in TVL. Daily transaction volume surpasses $23 billion, demonstrating institutional-grade throughput for global payments.

This strategic move capitalizes on TRON's established infrastructure while solving critical interoperability challenges. Market observers note the timing aligns with accelerating institutional demand for frictionless stablecoin rails.

Justin Sun Commits $20M to Trump-Backed Crypto Projects Despite Wallet Freeze Controversy

TRON founder Justin Sun has announced a $20 million investment in two U.S.-listed crypto ventures—$10 million each in World Liberty Financial (WLFI) and ALT5 Sigma Corp (ALTS)—despite an ongoing dispute with WLFI over frozen assets. The move signals Sun's continued bullish stance on politically-connected crypto projects even amid operational controversies.

The investment comes just days after Sun publicly criticized WLFI for freezing his tokens without explanation, calling the action "a violation of investor trust." Sources suggest WLFI's freeze targeted early large investors to prevent market dumping, a claim the project's team has neither confirmed nor denied.

Sun's dual investments appear strategically timed. The ALTS purchase capitalizes on undervalued crypto equities, while the WLFI allocation may serve as a diplomatic gesture to maintain influence over the Trump-affiliated project. Market observers note the frozen wallet contained an undisclosed amount of WLFI tokens acquired during early funding rounds.

Justin Sun Announces $20M Investment in WLFI and ALTS Amid Market Controversy

Justin Sun, founder of TRON and prominent cryptocurrency figure, revealed plans to invest $20 million in World Liberty Financial (WLFI) tokens and ALT5 Sigma Corporation (ALTS) stock. The dual $10 million allocations were announced via social media on September 5, 2025, framing the move as a bet on undervalued crypto-related equities.

The investment comes during heightened volatility for WLFI tokens following recent sell-off pressures. ALT5 Sigma, a Nasdaq-listed fintech specializing in institutional crypto infrastructure, has processed over $5 billion in digital asset transactions through its subsidiary.

Sun's public endorsement included tagging Trump family members and WLFI executives, suggesting potential political dimensions to the financial play. Market observers note the timing coincides with growing institutional interest in blockchain-based financial solutions.

Trump-Backed WLFI Token Plummets 54% Post-Launch Amid Supply Controversy

World Liberty Financial's native token WLFI debuted on major exchanges including Binance, Coinbase, and OKX this week, only to collapse 54% from its $0.36 peak. The drop followed revelations of mismatched tokenomics, with circulating supply potentially exceeding disclosed figures.

Blockchain analyst Quinten Francois identified irregular allocations, including Tron founder Justin Sun holding 3% of total supply. HTX exchange compounded volatility by offering 20% APY on WLFI deposits, creating sell pressure as whales exited positions.

The failed launch contrasts with ongoing successful ICOs in the market, underscoring the risks of opaque distribution models in DeFi projects. Exchange listings failed to stabilize the asset as retail traders absorbed losses.

Trump-Linked WLFI Token Faces Governance Crisis After Freezing Justin Sun's $500M Stake

World Liberty Financial (WLFI), the cryptocurrency project tied to Donald Trump's family, has plunged into controversy just days after launch. The abrupt freezing of Tron founder Justin Sun's 540 million unlocked tokens - alongside 2.4 billion locked tokens worth over $500 million - has exposed critical governance flaws and shattered the project's carefully cultivated alliance with one of crypto's most influential figures.

Sun, who invested $75 million into WLFI this year as its largest external backer, vehemently denied allegations of market manipulation. Blockchain analytics firm Nansen's data shows the token's sharpest sell-offs originated from other sources, though questions persist about Tron's involvement. The freeze has divided WLFI's nascent community, with critics pointing to Sun's controversial history while others decry the move as hypocritical for a project claiming decentralized credentials.

The political dimensions run deep. Trump's family controls 60% of WLFI's parent company and retains a staggering 22.5 billion tokens - approximately $5 billion at launch. This extreme insider concentration contradicts WLFI's decentralized branding, raising fundamental questions about the project's governance less than a week after its debut.

Justin Sun Blacklisted Amid WLFI Token Collapse

Justin Sun's alliance with the Trump-affiliated World Liberty Financial (WLFI) project has unraveled following a 61% price crash of the token shortly after launch. The Tron founder, previously a vocal supporter of Trump-aligned crypto initiatives, saw his address blacklisted, freezing approximately 595 million unlocked WLFI tokens.

Sun claims his transactions were minor technical tests without market impact, but the crypto community remains divided. Some allege manipulation, while others defend the moves as routine blockchain operations. The incident highlights the fragility of trust in crypto partnerships, particularly those tied to political figures.

WLFI had launched on major exchanges including Binance, Bybit and OKX, with Sun's holdings reportedly growing from a $30 million November 2024 investment to nearly $700 million pre-launch. The dramatic reversal underscores how quickly crypto alliances can sour when prices tumble and accusations fly.

TRON TRX Price Eyes $0.34 Breakout Amid Buyer-Seller Standoff

TRON's native token TRX remains locked in a tense battle between buyers and sellers, with price action stubbornly consolidating around the $0.34 level. The stalemate reflects weakening momentum as technical indicators flash neutral-to-bearish signals.

Flattening exponential moving averages and a MACD histogram printing negative values reveal fading bullish conviction. The RSI's mid-40s positioning suggests neither dominance nor capitulation from either camp. Traders await a decisive break above immediate resistance at $0.3621 or a breakdown from current support.

WLFI Blacklists Justin Sun’s Wallets Amid Token Dumping Allegations

World Liberty Financial (WLFI) has blacklisted a wallet linked to TRON founder Justin Sun, freezing 595 million WLFI tokens. The move follows suspicious transfers of nearly 60 million tokens to Binance, sparking debates over decentralization and protocol trust.

Sun denied allegations of dumping, calling the blacklisting unjust. The crypto community remains divided, with some defending his actions while others accuse him of market manipulation. WLFI’s price has dropped 17.9% in a week amid growing concerns over centralization.

No formal explanation has been released by WLFI’s core team, but on-chain data reveals the blacklisting was executed via the guardianSetBlacklistStatus function. The incident highlights ongoing tensions in DeFi governance and investor rights.

TRON (TRX) Tests Key Support at $0.34 Despite $110M Treasury Investment

TRX hovers at $0.34, down 0.24% as bearish technical signals overshadow a major treasury expansion. The token's RSI at 46.15 suggests neutral momentum with potential downside pressure.

Tron Inc.'s $110 million investment from Bravemorning Limited doubled its treasury to $220 million, yet failed to ignite bullish momentum. Market participants appear to have priced in the news, shifting focus to technical resistance formed after TRX's 26% 90-day rally.

September's $2.95 million net outflows indicate profit-taking by institutional players, creating headwinds despite fundamental strength. The divergence between institutional backing and price action highlights crypto markets' complex dynamics.

Is TRX a good investment?

Based on current technical and fundamental analysis, TRX presents a mixed investment case. The token is testing critical support at $0.34 with technical indicators suggesting potential for both breakout and breakdown scenarios.

| Factor | Bullish Signal | Bearish Signal |

|---|---|---|

| Technical Position | MACD positive momentum | Below 20-day MA |

| Market News | USDT integration progress | Regulatory controversies |

| Support Level | $0.3276 holding | Testing key resistance |

| Institutional Activity | $110M treasury investment | Wallet freeze concerns |

According to BTCC financial analyst James, 'Investors should monitor the $0.3276-$0.3467 range closely. A breakout above the moving average with volume could signal buying opportunities, while breakdown below support warrants caution.'